Really Bad Credit Card Offers

I get bad credit card offers in the mail. I mean, I get REALLY bad credit card offers in the mail. I understand that I ruined my credit, and I am making serious inroads towards correcting my mistakes, but I still get bad credit card offers.

I guess I should just shred them -- I am not really looking for another "entry" card. I have three current cards, all with low credit limits and no monthly balances. I have a couple of gas cards, and I primarily use my checking account debit card for almost all of my purchases. Still, I would like to have one of those shiny fancy-pants rewards cards -- just like the ones that I recommend to all of my friends. It kills me to know that every time I make a charge to my debit card that it is not going on my Starwood American Express or my American Airlines Aadvantage MasterCard or my Marriott Rewards Visa. I love my miles and points...and it kills me that there are points, available for the taking, and I just can't get them. Instead, my debit card gets Visa Extra points. To say Visa Extra points are better than nothing might be selling nothing short. After I earn another 10,000 points, I can exchange all of the points in my account for one free night at any Radisson hotel in the United States. You get one point for each dollar spent, so I am about another six months away from a free night at the Radisson! Of course, if I had a Starwood AmEx, with the same amount of points I have in my account right now, I could get about five nights in a room with an approximate room rate of $250-300/night. Of course, the one advantage to the Visa Rewards points is that you can exchange them for other stuff besides hotel rooms or flights. I could trade all of my points right now for a $100 gift card to a number of restaurants (i.e. Olive Garden, TGI Friday's, etc.). Not all that appealing an option. I can almost get a $100 Amazon certificate. Anyway, you get the idea. For the same amount of money spent with a travel rewards card, I could be getting approximately 10-15 TIMES the benefit of what I get with Visa Extras.

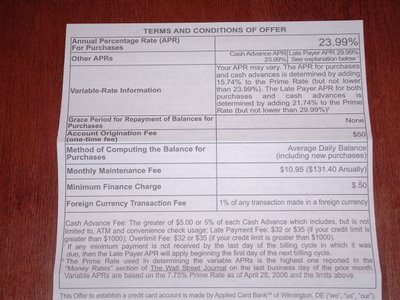

Anyway, about the bad credit card offer. The real question is WHO would order a card with these terms? I understand that there are people in serious financial straits. But, what kind of logic tells you that this type of credit card can help you? The details on this card say that there is a one-time "account origination" fee of $50. OK...it is going to cost me 50 bucks for someone to open an account for me? No thanks. Apparently, the cost of doing business must also be really hurting these folks, because they are also charging a monthly "maintenance fee" of $10.95 PER MONTH. Mind you, a good credit card should have no processing fee or monthly fee. An EXPENSIVE rewards card may have an annual fee of $65 or $80 per year, but you get back some rewards for that, and you get a substantial credit limit. Here, an annual fee of $131.40 rewards you with the privilege of running up new credit card debt. If you are planning on keeping a balance on the card (not recommended at all, but sometimes things happen, no?), they are going to hit you for 24% interest; miss a couple of payments and that shoots up to 30%. If the prime rate continues to climb (and the Fed Chair seems to indicate that it might), your interest rate will rise accordingly.

The letter that accompanied the above pictured flyer offered me a guaranteed credit limit of $500! Wow! I can pay over $130 per year for the privilege of borrowing all of $500. Actually, though, you don't get a $500 limit, either. Your first bill will include the $50 one-time fee and $10.95 for the first month's maintenance fee. So, the initial credit limit will be all of $439 -- and starting immediately, you better be making payments on time.

All I know is that this is some seriously expensive credit. Anyone who is in bad enough financial shape to need this credit card needs to really evaluate how bad they need any credit card.

So, who is this purveyor of crap? A fine company called Applied Card Systems. If New Yorkers needed any more reason to vote for Eliot Spitzer in the upcoming gubernatorial election, you should know that he filed a lawsuit against this fine company for predaory lending practices and slimy collection procedures. Personally, I was shocked to find this company is anything less than above-board with people. I am not one for big government, but any attempt to curb the hideous lending practices that many companies employ is welcomed.

2 comments:

Believe it or not I found your blog motivating to be consistant and to hold yourself accountable.

Fix your credit first and then apply for a rewards credit card. Otherwise it will cost you more to have those cards.

Post a Comment